Our Mission

Our Mandate

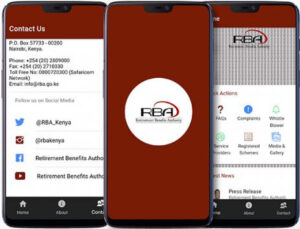

Retirement Benefits Authority (RBA) is a regulatory body under the National Treasury, established under Retirement Benefits Act. The Retirement Benefits Act was enacted as part of the on-going reform process in the financial sector in order to bring the retirement benefits industry under a harmonized legislation, to address the many problems that have hitherto faced the industry.

Regulate and Supervise

the establishment and management of retirement benefits schemes;

Protect

the interests of members and sponsors of retirement benefits sector;

Promote

the development of the retirement benefits sector

Advise

the Cabinet Secretary, National Treasury on the national policy to be followed with regard to retirement benefits industry

Implement

all government policies relating to the industry

Overarching Goal

Achieve 30% pension coverage with an asset base of 2.4 Trillion Shillings by 2024

Our Vision

An inclusive, secure and growing retirement benefits sector.

Our Mission

To proactively promote savings for retirement in Kenya through safeguarding, supervising and facilitating the development of the retirement benefits sector

Our Quality Policy:

“Proactively promoting savings for retirement in Kenya by safeguarding, supervising and facilitating the development of the retirement benefits sector through

- Commitment to Continued Excellence in Service Delivery;

- Upholding Professionalism, Integrity and Sensitivity to Stakeholder Interests;

- Operating a quality management system within the framework of ISO 9001:2015 Standard; and

- Continually improving on the effectiveness quality management system.”

Core Values

The Authority is committed to adhere to the following core values, for which the acronym RETAIN has been adopted:

Responsiveness

We shall respond effectively and in a timely manner to the needs of our stakeholders.

Transparency and Accountability

We shall conduct our work in an open and honest manner and be responsible for all our actions.

Integrity

We shall be honest, ethical and fair while delivering our services and not tolerate any form of corruption.

Innovation:

We shall constantly strive to redefine the standard of excellence in everything we do and constantly apply creative ideas to meet our stakeholders’ changing needs and support innovation in the retirement benefits sector.

Objective of the RBA

- Improve Access to Authority Services

- Improve Retirement Benefits Sector Governance

- Improve Customer Experience

- Enhance Confidence in the Retirement Benefits Sector

- Enhance Retirement Benefits Sector Contribution to the Big 4 Agenda

- Increase Pension Coverage to the informal sector workers

- Increase Pension Coverage to the informal sector workers

Retirement Benefits Authority Business Continuity Policy Objectives

- To obtain certification to ISO 22301:2019 by August 2023.

- Increase overall BCMS competence by undertaking ISO 22301 Auditors Training for the Business Continuity Champions.

- To ensure identified Recovery Time Objectives are achieved as per the Business Impact Analysis.

- To maintain a 99% uptime of systems by employing effective disaster recovery systems.

- Ensure continuous improvement of RBA BCMS

Retirement Benefits Authority BCMS Policy Statement

- The Retirement Benefits Authority is committed to implementing, maintaining and continually improving a Business Continuity Management System to protect against, reduce the likelihood of the occurrence of, prepare for, respond to and recover from disruptions when they arise.

- The Authority is committed to ensure continuity to all appropriate critical operations as defined by the BCMS scope document in order to protect people, assets and guarantee timely recovery of its critical operations in the case of a disruption so far as is reasonably practical.

- This is to ensure continued regulation, supervision, promotion and development of the retirement benefits sector in the event of a disruptive incident.