Blogs

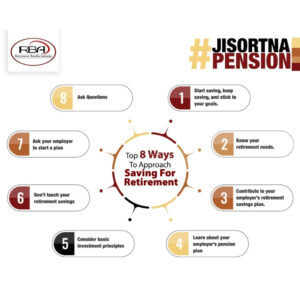

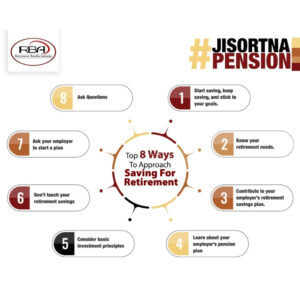

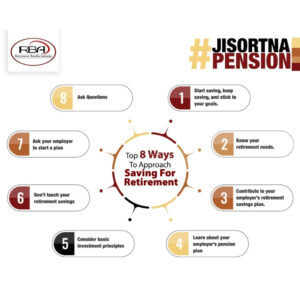

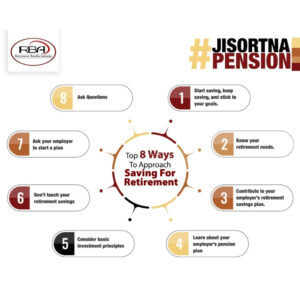

Top 8 ways to Approach Saving for Retirement

1) Start saving, keep saving and stick to your goals.If you are already saving, whether for retirement or another goal, keep going. If you’re not

March 5, 2023

1) Start saving, keep saving and stick to your goals.If you are already saving, whether for retirement or another goal, keep going. If you’re not