Plan your retirement

Summary

in Pro Version

Payment methods

pro Feature Availablein Pro Version

Credit Card details

pro Feature Availablein Pro Version

Your service request has been completed!

We have sent your request information to your email.Levy calculator

in Pro Version

Payment methods

pro Feature Availablein Pro Version

Credit Card details

pro Feature Availablein Pro Version

Your service request has been completed!

We have sent your request information to your email.Retirement Levy Table

| Size of Scheme Fund (Ksh) | Annual Levy Rate – % of Fund |

|---|---|

| First Shs 500M | 0.2% |

| Shs 500M – Shs 1B | 0.15% |

| Shs 1B – Shs 5B | 0.1% |

| > Shs 5B | 0.05% |

- Service Delivery Charter

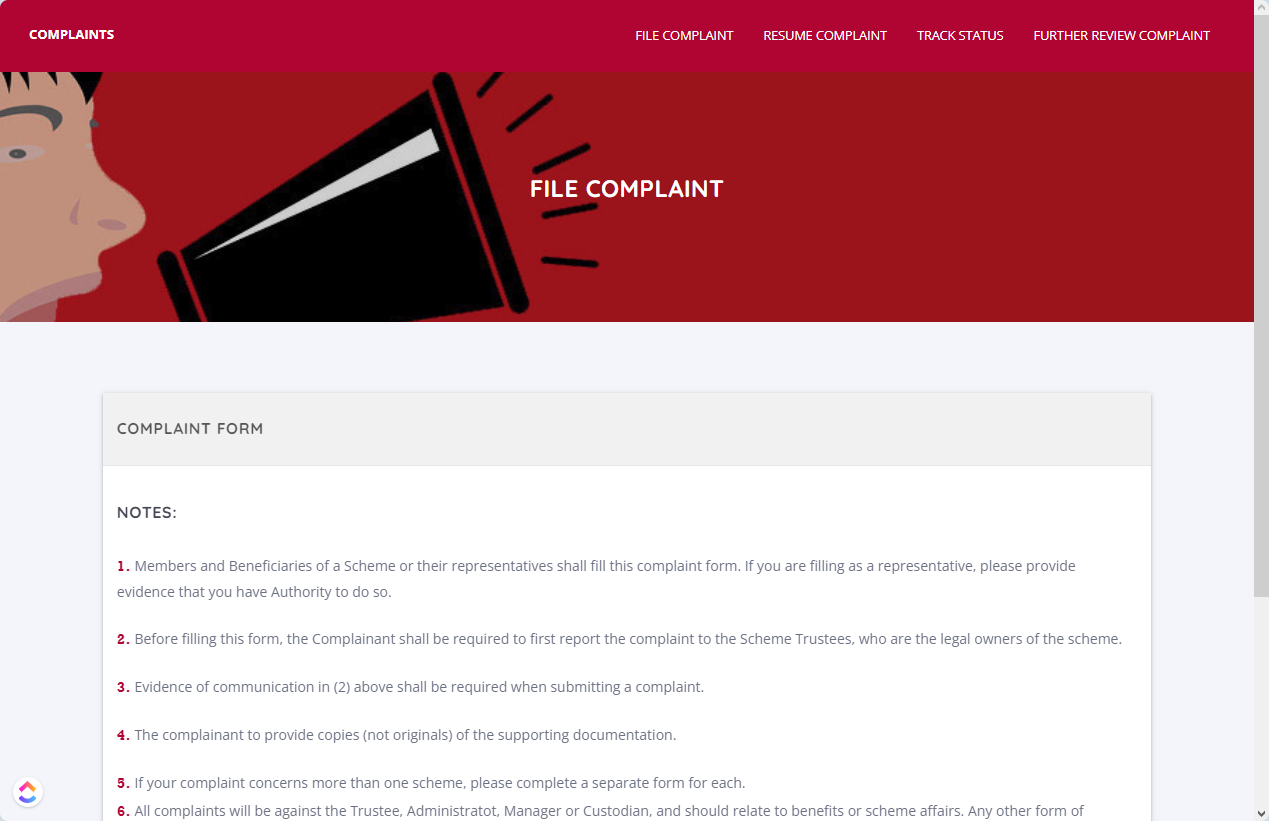

Requirement to obtain services: File an official complaint or dispute with regards to the running of retirement benefit scheme.

Cost: No cost

Timeline: Acknowledge your complaint within 2 working days. Aim to reply within 10 working days

i. Member Education:

Requirement to obtain services: Trustees to request the Authority.

Cost: No cost

Timeline: We will Reply within 7 working days

ii. Trustees Training:

Requirement to obtain services: Respond to the Authority’s invitation

Cost: No cost

iii. Retirement Planning:

Requirement to obtain services: Respond to Authority’s invitation

Cost: No cost

View upcoming training >

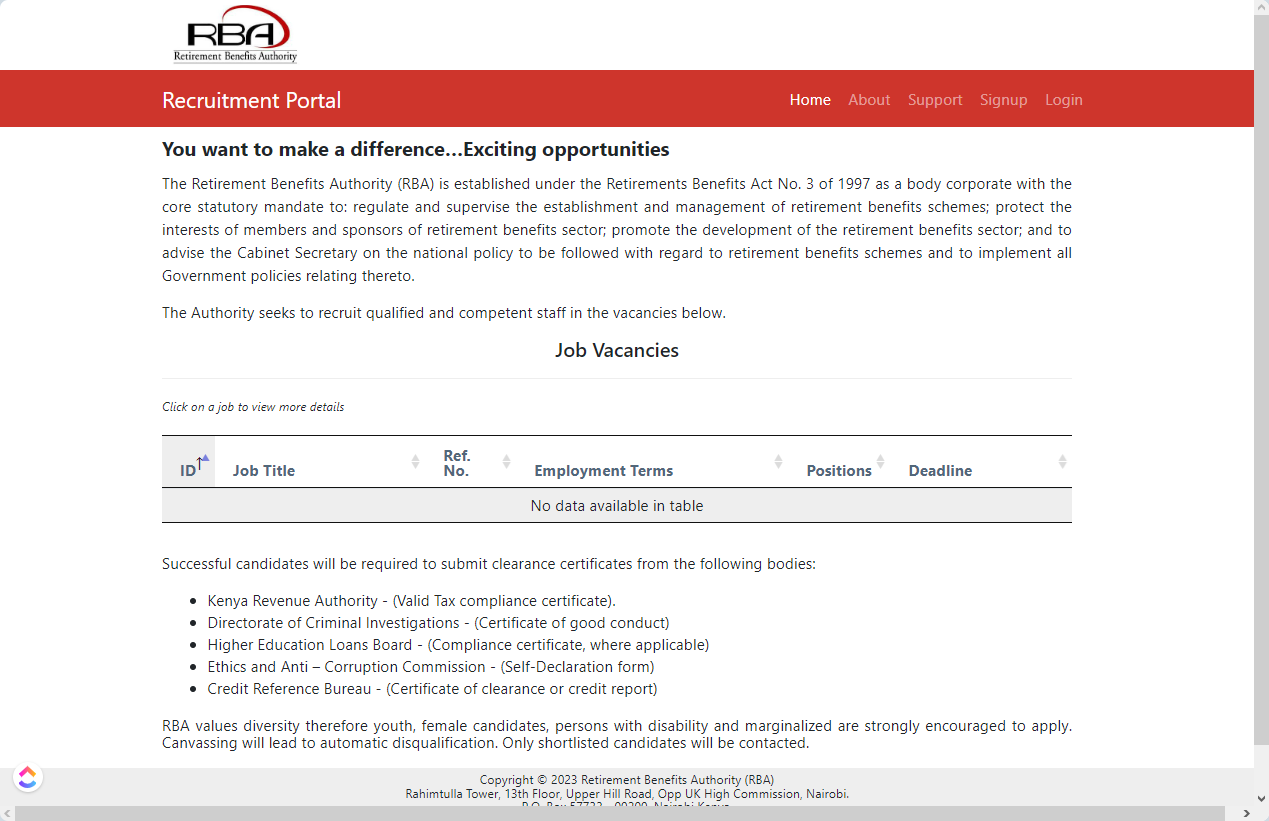

a. Registration of schemes-

Requirement to obtain Services: A4 Application form for occupational schemes, A3 forms for individuals schemes

Cost: No cost

Timeline: Registration within 90 days upon receipt of required documents.

b. Licensing of service providers

Requirement to obtain Services: Application forms

i. Fund Managers Fee- Ksh. 50,000

ii. Custodians Fee-Ksh. 50,000

iii. Administrators Fee-Ksh. 50,000

Call Us Toll Free No: 0800720300 (Safaricom Network) Timeline: Answer within three rings

Cost: No cost

Write to Us by letter , fax or email [email protected]

Timeline: Respond within 7 days after receipt

Cost: No cost

Visit our offices Rahimtulla Tower, 13th Floor,

Upper Hill Road, Opp UK High Commission.

P.O. Box 57733 – 00200

Nairobi, Kenya.

Timeline: See you within 10 minutes without an appointment or 5 minutes with an appointment

Cost: No cost

“HUDUMA BORA NI HAKI YAKO”

Our Mandate:

RBA begun with the enactment of the Retirement Benefits Act No. 3 of 1997 and subsequent establishment of Retirement Benefits Authority in October, 2000. The Act bequeathed the Authority a mandate to steer the retirement benefits industry through prudent regulation and supervision of the sector; promotion of development of the sector; protection of the interest of members and sponsors of retirement benefit.

Regulate and Supervise

the establishment and management of retirement benefits schemes;

Protect

the interests of members and sponsors of retirement benefits sector;

Promote

the development of the retirement benefits sector

Advise

the Cabinet Secretary, National Treasury on the national policy to be followed with regard to retirement benefits industry

Implement

all government policies relating to the industry

Stay up to date:

Follow us on our Socials

Latest News

Government gives nod to the National Retirement Benefits Policy

By Leviticus Adaki The National Treasury and Economic Planning has

You can now pay for RBA services via E-Citizen Platform

The Retirement Benefits Authority has integrated its payment services with

RBA Plans Sensitization Forums on Recent Regulatory Changes

The Retirement Benefits Authority (RBA) invites industry stakeholders to its

Upcoming Events

Publications:

Latest Publications

Learning Centre

Testimonials

Youtube Channel

Our Blog

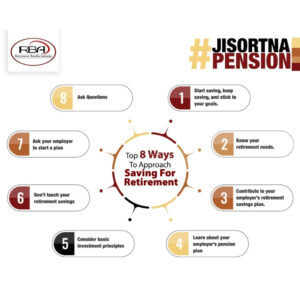

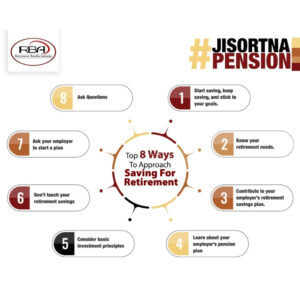

Top 8 ways to Approach Saving for Retirement

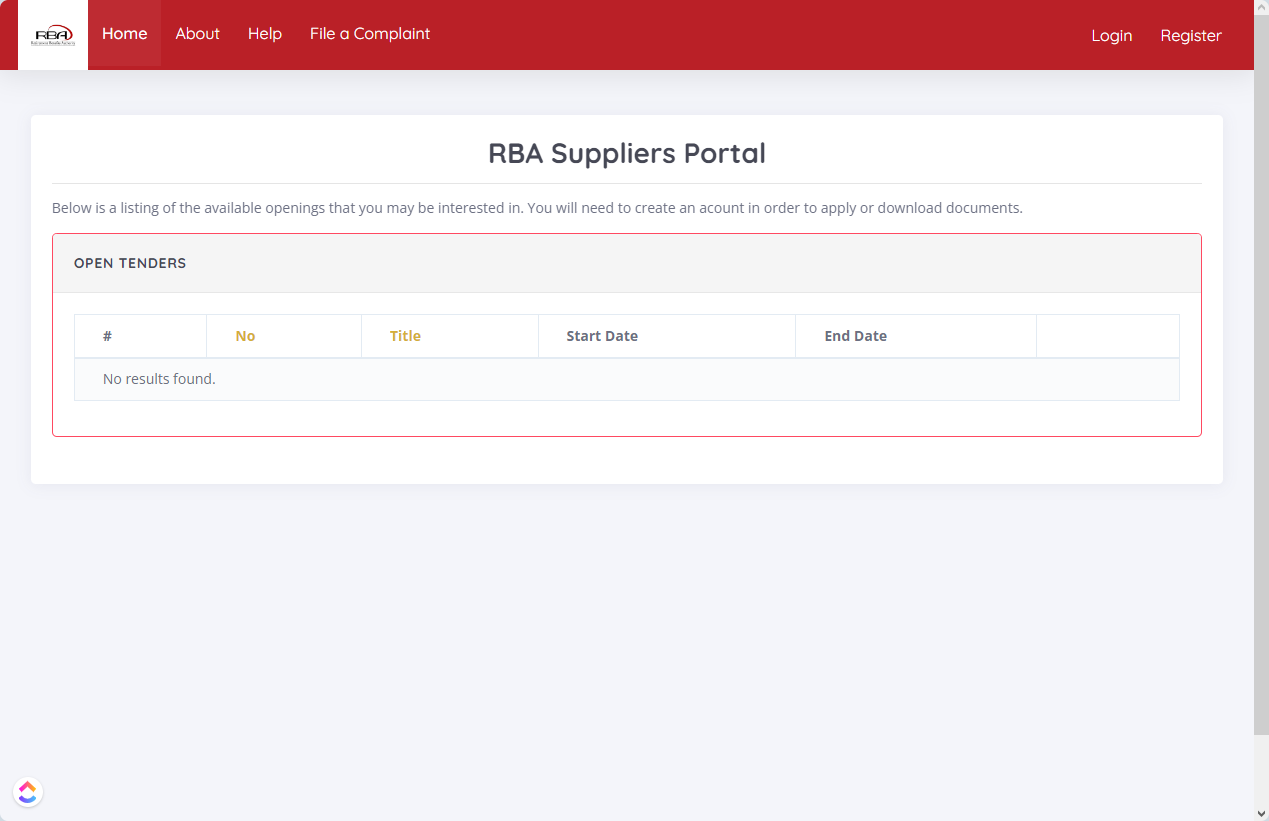

Online Services

Our Achievements

Safeguarding your Retirement Benefits

coverage

Pension Plan

Schemes